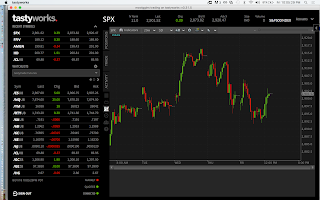

I was short the 2890 calls for the Monday and Wednesday expirations ... bad news as the close was at around 2905 Monday and 2915 or so on Wednesday. That's losses of X and Y ...

I've been using a different system with a couple of smaller accounts: going further out in time and just taking a fraction of the credit instead of holding to expiration. I'm going to try something similar in a (somewhat) larger account ...

If we go out to 21 DTE (Days to Expiration) and sell an iron condor 3 times per week ... then the return taking 1/2 the credit is about the same as holding to expiration for the 4-5 day expirations we have been using.

But look how much wider we can go, especially to the downside:

- 5 DTE: short the 2865 put

- 21 DTE: short the 2780 put

Tastytrade research finds that to get half the credit, you (on average) have to wait half the time. So putting multiple ones of these on, every 2 days, you start to close them for the profit in 10 days and therefore (on average) every 2 days from then on.

If you aren't showing a profit (or a full profit) after 10 days, close it anyway and move on. You'll have other profitable trades surrounding it ...

Here's the existing results ... losing string was broken today ...

| Expiration | Underlying | Long put | Short put | Short call | Long call | Credit Received | Result |

|---|---|---|---|---|---|---|---|

| 07/16/2018/ | SPX | 2680 | 2730 | 2810 | 2860 | $3.60 | Won 100% |

| 07/18/2018/ | SPX | 2700 | 2750 | 2820 | 2870 | $3.95 | Won 100% |

| 07/20/2018/ | SPX | 2700 | 2750 | 2835 | 2885 | $2.40 | Won 100% |

| 07/20/2018 (a.m.)/ | NDX | 7260 | 7310 | 7410 | 7460 | $5.99 | Won 100% |

| 07/25/2018 | SPX | 2705 | 2755 | 2835 | 2885 | $2.40 | lost 16% of amount at risk |

| 07/27/2018 | SPX | 2695 | 2745 | 2825 | 2875 | $3.50 | Won 100% |

| 07/30/2018 | SPX | 2720 | 2770 | 2850 | 2900 | $2.60 | Won 100% |

| 08/01/2018 | SPX | 2730 | 2780 | 2870 | 2920 | $2.15 | Won 100% |

| 08/03/2018 | CMG | 430 | 450 | 490 | 510 | $1.01 | Won 100% |

| 08/03/2018 | AMZN | 1692.5 | 1722.5 | 1887.5 | 1917.5 | $2.60 | Won 100% |

| 08/06/2018 | SPX | 2720 | 2770 | 2860 | 2910 | $2.05 | Won 100% |

| 08/08/2018 | SPX | 2740 | 2790 | 2860 | 2910 | $2.05 | Won 100% |

| 08/10/2018 | RUT | 1610 | 1640 | 1710 | 1740 | $1.53 | Won 100% |

| 08/10/2018 | AMZN | 1737.50 | 1767.50 | 1885 | 1915 | $1.79 | Lost about 30% |

| 08/13/2018 | SPX | 2760 | 2810 | 2885 | 2935 | $1.65 | Won |

| 08/15/2018 | SPX | 2760 | 2810 | 2860 | 2910 | $3.80 | Won |

| 08/17/2018 (a.m.) | NDX | 7310 | 7360 | 7460 | 7510 | $4.42 | Lost 7.07% |

| 08/22/2018 | SPX | 2720 | 2770 | 2860 | 2910 | $3.95 | Won 70% of possible |

| 08/24/2018 | SPX | 2745 | 2795 | 2880 | 2930 | $3.30 | Won 100% |

| 08/24/2018 | RUT | 1600 | 1650 | 1715 | 1765 | $2.16 | Lost 17.7% |

| 08/27/2018 | SPX | 2760 | 2810 | 2890 | 2940 | $2.45 | Lost 23% |

| 08/29/2018 | SPX | 2770 | 2820 | 2890 | 2940 | $2.95 | Lost 47% |

| 08/31/2018 | SPX | 2795 | 2845 | 2925 | 2975 | $2.55 | Won 100% |

That's 17 for 22: 77.97% ...