The one exception is Netflix, which bounced back too strongly from its earnings miss:

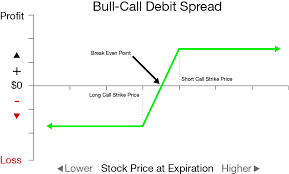

My short call strike for NFLX is 335, so I also put on a debit call spread this a.m.:

Long the 330 call and short the 335, for $265 ... meaning that if NFLX is at or above $335 on August 2 when this expires, I make $235.

This covers most of what I can lose on the NFLX Iron Condor I have going, and I can actually do this again the following week if conditions seem favorable (i.e. if NFLX continues up ...)

Now, back your $150000 retirement account ... since you didn't pull the trigger on this immediately you didn't suffer the $5000 (for you $50000!) loss from last week ... instead you'd have had a much smaller loss, as I would have taken 1/2 the risk and diversified over 3 trades:

- NDX would lose 100% of what was risked, as last week's trade lost about 80% because of its very wide strikes

- SPX would break even or lose small, maybe 15% of the amount at risk at most

- RUT does what it's supposed to do: expires worthless for full profit, probably 10% or so

So your loss would have been maybe $7000 .. probably just $6000 for the week because of other profitable trades that week. So you'd have gone from $158000 to $152000.

Once again, this offer is just for one lucky individual willing to try this ... let me know if you're interested and we can get going this week ... or you can wait and watch for a few more weeks, understandably ... More next week!